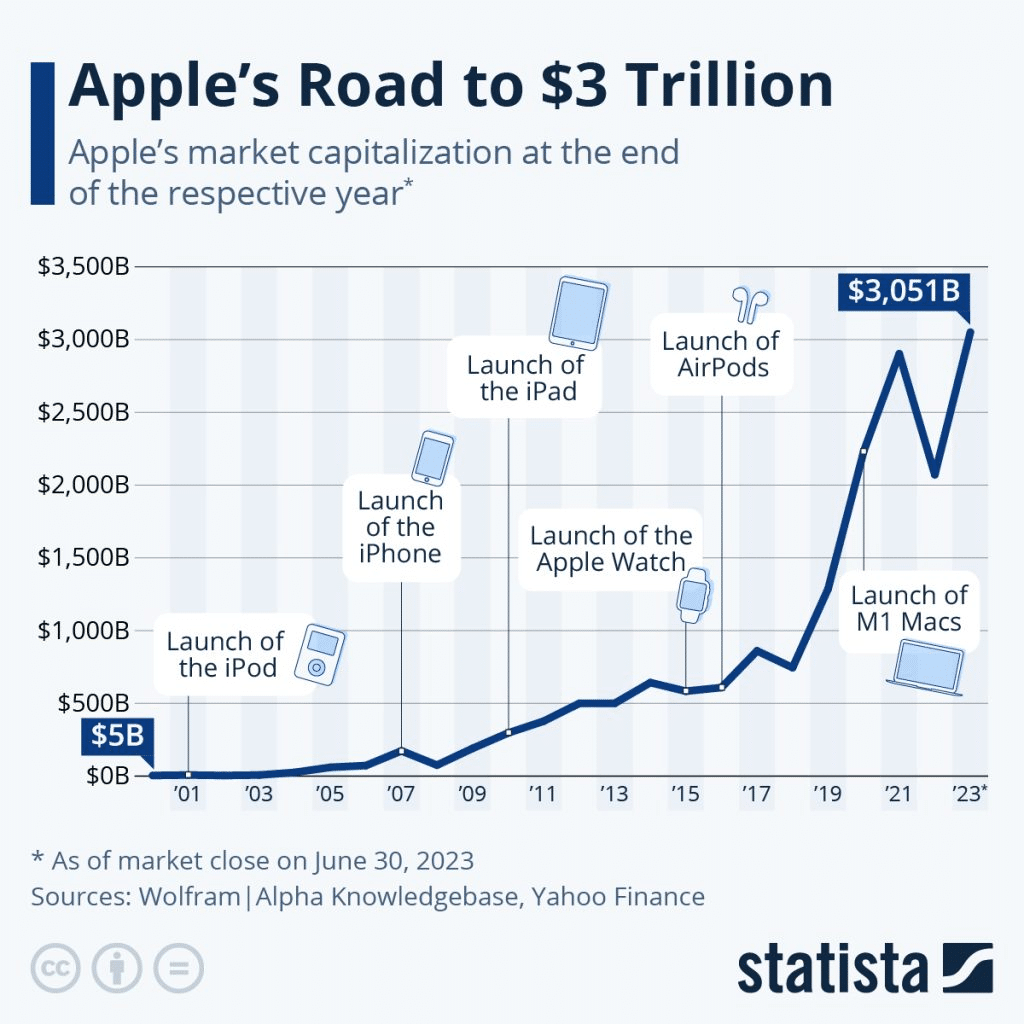

Apple was able to capitalize on its market above the limit of three trillion dollars for the first time on June 23, 2023. The share was first able to climb the stairs by making a significant gain of 2.31% and made its share price worth $190.73, creating a new milestone in markets.

It also hit the $3 trillion mile in January 2022, but the achievement was short-lived, and it climbed back the stairs, mesmerizing traders, and investors. However, the new achievement has created hope for traders and investors, making it one of the companies with the most liquidity in the market.

The Numbers Behind the Meteoric Rise

While the Apple share continues its rise, its earnings have been lagging over the last 3 quarters. Apple missed its earnings for Q1 and Q3. The reason behind the miss is mainly attributed to the lackluster iPhone sales over the last few quarters. The iPhone forms more than 50% of Apple’s net revenue and that is the reason it’s one of the major drivers of Apple’s stock price. The launch of the new iPhone is just a few weeks away now and there is an expectation that we could see some significant upgrades over the previous versions.

Apple saw its first earnings per share (EPS) de-growth in the last 3 years. It comes on the back of shrinking margins, lower demand, and increased competition across its segments. Analysts still continue to be bullish on the Apple stock, with no analyst giving a sell call currently and an average target price of $200 per share. Apple’s new upgrades have come on the back of increase in Price to Earnings (PE) multiples and positive expectations from its new product line for 2023 & 2024.

Apple is currently trading at 30 times its current earnings, which is above its historical average of 20-25x earnings. With earnings growth expected between 8-10% for 2024, any kind of miss on these targets could see some downgrades for the stock.

Product plan

Vision Pro

Apple surprised the world with the launch of its Vision pro AR headset during its developer conference in June. The new product brought excitement to its current product line and people are eagerly waiting to use it when it launches in 2024. The cost aspect will be a challenge as the vision pro would be the most expensive AR set priced at $3500, while its competitors price their AR sets in the range of $500-1000.

Apple has reportedly cut its targets for Vision Pro shipments when it launches the cutting-edge headset next year. The initial million headsets it wanted to produce will be drastically cut to around 400,000 in 2024 as per some reports. The alleged internal sales target for the first 12 months was 1 million units.

Manufacturing issues surrounding the headset’s complex design have forced Apple to both reduce its target shipments for the inaugural Vision Pro as well as delay its plans for a cheaper second-generation version.

iPhone

iPhone assembler Hon Hai expects muted sales in 2023 as electronics demand weakens globally.

Apple, Hon Hai’s top customer, in August telegraphed its longest sales slump in decades, the result of crumbling demand for phones, computers and tablets worldwide. China, the world’s biggest market for those devices, is mired in an economic funk that some economists say may worsen over time.

Apple is asking suppliers to produce about 85 million units of the iPhone 15 this year, roughly in line with the year before. That is aiming to hold shipments steady despite tumult in the global economy and a projected decline in the overall smartphone market. But the move is likely to increase revenue overall because Apple is considering raising the price for Pro models.

New iPhones will go on sale on September 22, citing sources. That falls on a Friday, and if history is any indication, Apple begins selling its new iPhones on the Friday after they’ve been launched – this implies the big reveal would take place on September 12 or 13 (the former being more feasible).

AI

Apple’s hefty research spending may have been boosted by the current AI boom. The company’s research and development spending hit $22.61 billion for the year so far, a figure that’s $3.12 billion higher than this time last year, its third quarter earnings showed. CEO Tim Cook said some of this budget was driven by Apple’s work on generative AI.

The tech giant has been notably quiet on AI — a stark contrast to some of its main competitors. Meta, Microsoft, and Google have all been engaged in what has been dubbed an AI arms race as they rush to bring new products to the market.

Summary

As Apple continues to be the only 3 trillion-dollar company in the world, valuations are a little lofty and any sort of deviation from its current guidance could see the stock pullback on some of its recent gains. On the other hand, if the new iPhone delivers big on innovation & design, then we would see the growth numbers revised on the upside for Apple. The success of the vision pro will also be an important catalyst for Apple’s earnings in 2024.