The stock markets are random, erratic and volatile, even at the best of times. And there are only a handful of predictable movements that one can anticipate every year to plan investments. One such popularly recognized theory happens to be the January Effect – a calendar-based anomaly that tends to drive stock market trends almost every year. And since we are almost at the end of December now, it would be a good idea to plan for wave ride, don’t you think?

Here is an all-you-need-to-know guide about January Effect and all the ways it can impact your investment portfolio.

What is January Effect?

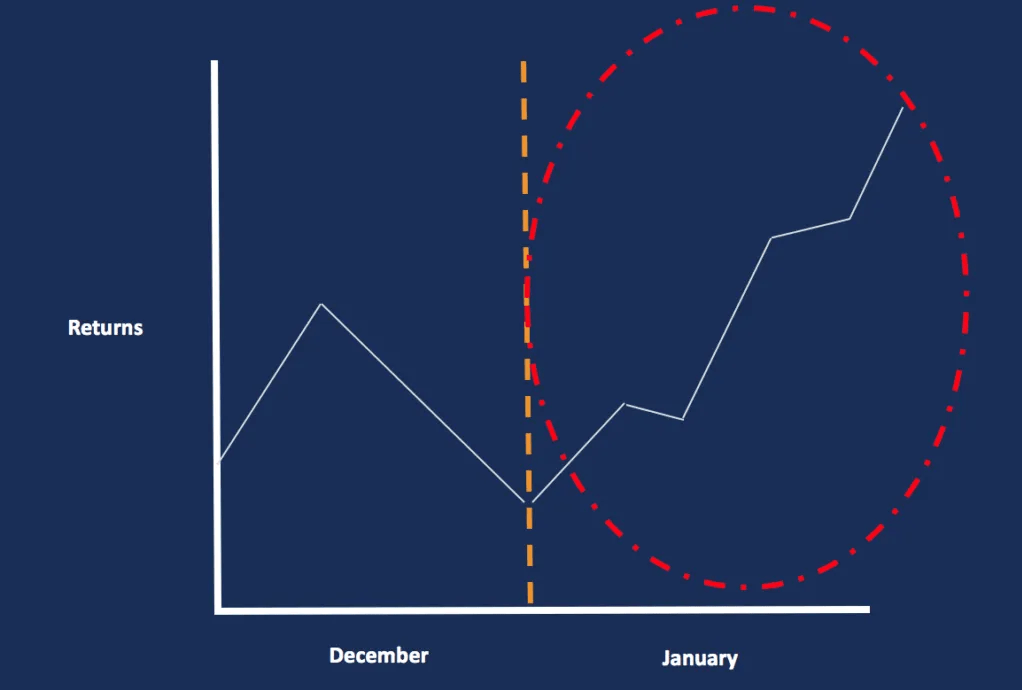

The January Effect is a stock market anomaly that takes hold just as December ends and the exciting anticipation of a new year and all its possibilities begin to fill people with optimism. Technically speaking, the January Effect Hypothesis states that there is a seasonal effect in the financial market where security prices tend to rise more than any other month of the year. It tends to provide investors with an opportunity to buy stocks at lower prices in December and sell them as their prices increases after the January Effect takes hold.

What drives the January Effect?

• Tax based gains

The most common reasoning behind the existence of this effect in the market stems from the behaviour of individual/retail investors who are income-tax sensitive. The effect tends to affect small-cap companies more than mid and large-cap stocks owing to their lower liquidity. Retail investors tend to sell off underperforming stocks in the month of December to lock-in capital losses for income tax purposes. This causes a temporary dip in prices that tends to reverse itself in January as demand picks up again.

• Year-end Bonuses

Another possible driver behind the January Effect is year-end bonuses that tend to provide investors with extra liquidity, some of which is used to stock market investments that ends up driving prices higher.

• Anticipation

The psychology of starting things fresh as the new year begins also contributes to this trend, generating more demand as people begin looking for new investments as the year begins.

How to prepare for January Effect as an investor?

January Effect has historically created a larger impact on small-cap stocks. Therefore, these are the specific securities that you need to keep an eye on. Think about making some small-cap additions to your portfolio that you can later offload in January after prices go up. Should the January Effect take hold, you will have a good chance to lock in some gains and rebalance the original asset allocation ratio in your portfolio. But remember to do your research and study the fundamentals of the company you are looking to invest into. Look into the company’s financial health, growth prospects, profit margins and so on. This data will give you a good idea about the stocks you should pick to gain from the January Effect anomaly, especially in terms of the capital appreciation potential they hold.

So, there you have it folks – prepare for the New Year to begin and enjoy the seasonal gains offered by the January Effect.

Source – https://www.linkedin.com/pulse/january-effect-hypothesis-getting-ready-ride-wave-vpfx